Deutsche Telekom to Acquire VoiceStream

- Share via

Deutsche Telekom has agreed to acquire fast-growing mobile telephone company VoiceStream Wireless Corp. for $50.5 billion, a move that would give the German telephone giant a crucial foothold in the United States but also touch off a controversy about foreign ownership, sources familiar with the situation said Sunday.

The deal, if approved by regulators, would give Deutsche Telekom access to more than 2.3 million VoiceStream customers and the potential to serve as many as three-quarters of U.S. mobile phone users--breadth that would allow the German company to challenge the nation’s current wireless leaders.

The German firm is expected to seek other acquisitions as well, as part of an effort to become a dominant global player in telecommunications. However, the proposed acquisition will have no immediate impact on VoiceStream’s customers and will have no impact in California, where VoiceStream does not yet sell service.

Their boards formally approved the deal Sunday, sources said, but VoiceStream and Deutsche Telekom declined to confirm the deal. A formal announcement of the cash and stock merger, rumored for more than a week, could come today, sources said.

Under the agreement, Deutsche Telekom will pay 3.2 shares, plus $30 in cash, for each VoiceStream share. The deal values VoiceStream at about $195 a share, or $16,900 per wireless subscriber. The German company also will assume $5 billion in VoiceStream debt, sources said.

Investors holding more than 50% of VoiceStream agreed to back the deal, one source who declined to be named told Reuters.

Shareholder approval, however, is likely to be a small matter compared with the political battle that could be afoot if the merger is inked as expected.

Many legislators have already voiced concerns about the potential sale of a U.S. phone company to a German firm with substantial government ownership. A group of 29 senators led by Ernest F. Hollings (D-S.C.) recently urged the Federal Communications Commission to consider national security implications of any foreign acquisition of a U.S. telecommunications firm.

FCC Chairman William E. Kennard pledged last week in a letter to the senators that he would give “close scrutiny” to any such takeover attempt.

“They’re going to have a really hard time getting regulatory approval for this. There’s a tremendous amount of risk,” said a trader who specializes in takeover stocks.

Deutsche Telekom hopes to allay U.S. concerns by pointing out that the VoiceStream deal would reduce the German government’s stake in the company from the current 58% to 45%.

In addition, the European Commission warned on Sunday that a draft U.S. bill aimed at blocking a dominant European telecommunication firms from acquiring U.S. phone companies would have global trade implications if adopted.

A U.S. law prohibits the acquisition of a U.S. telephone company by any firm that is more than 25%-owned by a foreign government. But the law gives regulators discretion to waive that limitation if a deal is deemed to be in the public interest.

There might also be foreign-ownership limits attached to some of the wireless licenses held by VoiceStream.

Last week, industry analysts hailed a potential VoiceStream deal as being less likely to touch off political opposition than a merger between Deutsche Telekom and a more established firm such as Sprint Corp. or a fiber-rich firm such as long-distance company Qwest Communications International Inc.

Analysts expect the VoiceStream acquisition to be just the first of several U.S. deals involving Deutsche Telekom. The company has held recent merger talks with Qwest officials but is said to have backed off a potential deal with Sprint because of concerns about regulatory resistance.

VoiceStream, meanwhile, is considered a good catch for the ambitious German firm.

Before the deal closes, Deutsche Telekom also will provide VoiceStream with an initial $5-billion cash infusion that will allow the Bellevue, Wash.-based firm to bid for additional mobile service licenses in the upcoming auctions of U.S. wireless spectrum, sources said.

In exchange, Deutsche Telekom will receive convertible preferred stock, sources said.

“That could be used as a war chest to participate in auctions--if and when they happen--and to aggressively build-out their network and to be opportunistic with spectrum acquisitions,” ABN AMRO analyst Kevin Roe told Reuters.

VoiceStream already owns wireless licenses covering about three-quarters of the U.S. population--or more than 200 million people. However, much of that network is not yet built, and it will take years and millions of dollars to complete.

The company has about 2 million mobile customers, placing it well behind U.S. leaders Verizon Wireless (more than 25 million U.S. customers), AT&T; Wireless (more than 12.5 million) and Sprint PCS (more than 6.5 million).

VoiceStream, however, is growing fast. It was spun off from Western Wireless Corp. last year and already employs 8,200 workers, with about 1,000 in Washington state. It completed two acquisitions of its own earlier this year: Aerial Communications Inc. for $5.6 billion and Omnipoint for $7.2 billion.

In addition, it has struck partnership deals with several other companies that will allow it to sell VoiceStream service in their markets.

VoiceStream’s partnership with Cook Inlet Region Inc., for example, will allow it to serve Los Angeles, San Francisco and Santa Barbara once those mobile networks are completed.

Still, VoiceStream could move to buy those licenses outright as well as buy new licenses that would allow it to fill service gaps in San Diego and other California regions as well as in Nevada and the southeastern U.S.

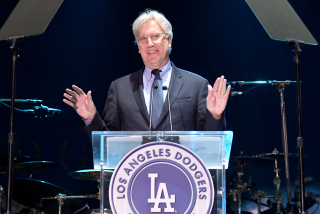

The man credited with building VoiceStream, Chairman and Chief Executive John Stanton, will remain with the combined company and oversee Deutsche Telekom’s new U.S. wireless operations, sources said.

VoiceStream posted a first-quarter loss, before interest, taxes, depreciation and amortization, of $31.4 million.

Despite the heavy losses, the company is attractive to Deutsche Telekom because it is one of the last independent nationwide wireless carriers in the United States. In addition, VoiceStream’s wireless network uses a technology known as global system for mobile communications, or GSM, the same technology used by Deutsche Telekom and the dominant digital wireless standard in Europe and Asia.

Still, last week shares of Deutsche Telekom fell on fears that it would overpay for VoiceStream, traders said.

*

Reuters and Associated Press were used in compiling this report.